Workers’ Comp for Union Employees

We represent union workers throughout Ohio.

Union workers often face dangerous conditions on the job — from heavy equipment and construction sites to repetitive stress and shift work. While being part of a union provides important protections, when it comes to workers’ compensation in Ohio, union membership doesn’t automatically make the process easier.

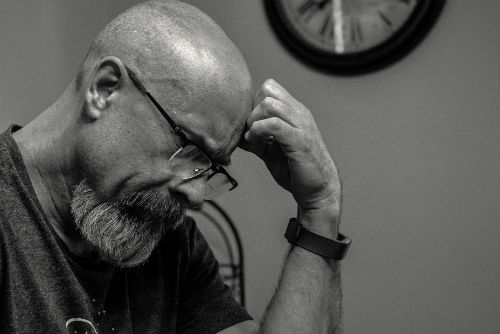

I’m Thomas Marchese, a Columbus workers’ comp attorney who has been representing Ohio workers for nearly four decades. I understand how union contracts and workers’ compensation laws intersect, and I’m here to help union members get the benefits they’ve earned after a workplace injury.

Do Union Workers Qualify for Workers’ Compensation in Ohio?

Yes. Union employees are entitled to the same workers’ compensation benefits as any other Ohio worker. If you’re hurt on the job, you can file a claim with the Ohio Bureau of Workers’ Compensation (BWC), regardless of your union membership.

However, union workers sometimes face additional layers of complexity:

- Collective bargaining agreements (CBAs): Your contract may outline specific procedures for reporting injuries.

- Employer challenges: Even in union jobs, employers may fight or delay claims to avoid costs.

- Coordination with union reps: While your union may support you, they don’t replace the role of an experienced attorney who can handle the legal side.

Common Injuries Among Union Workers

Union jobs often involve physically demanding or hazardous work. Some of the most frequent union worker injuries include:

- Construction site accidents (falls, heavy equipment injuries).

- Repetitive motion injuries like carpal tunnel or tendonitis.

- Back and shoulder injuries from heavy lifting.

- Machinery-related accidents in industrial or factory settings.

- Occupational illnesses from chemical or hazardous exposure.

What Benefits Can Union Workers Receive Through Workers’ Comp?

If your claim is approved, you may be eligible for:

- Medical treatment: Coverage for surgery, therapy, and ongoing care.

- Lost wage benefits: Temporary or permanent disability pay if you can’t return to work.

- Vocational retraining: If your injury prevents you from returning to your union trade.

- Death benefits: For surviving families after a fatal workplace accident.

Your union benefits (such as health insurance or disability programs) may supplement workers’ comp, but they do not replace your right to file a workers’ comp claim.

What Benefits Can Union Workers Receive Through Workers’ Comp?

If your claim is approved, you may be eligible for:

- Medical treatment: Coverage for surgery, therapy, and ongoing care.

- Lost wage benefits: Temporary or permanent disability pay if you can’t return to work.

- Vocational retraining: If your injury prevents you from returning to your union trade.

- Death benefits: For surviving families after a fatal workplace accident.

Your union benefits (such as health insurance or disability programs) may supplement workers’ comp, but they do not replace your right to file a workers’ comp claim.

How Does a Union Contract Affect a Workers’ Comp Claim?

Union contracts can add unique steps:

- Reporting requirements: Some CBAs require specific timelines for reporting an injury.

- Union representation: Your union steward may attend hearings or meetings with you.

- Return-to-work policies: Union rules may affect how and when you return to your position.

That said, the workers’ compensation system is separate from your union contract. Even if your union supports you, an experienced workers’ comp lawyer ensures your case is properly documented and presented before the Ohio BWC.

Why Union Worker Claims Get Denied

Unfortunately, many union worker claims still face denials, often because:

- The employer disputes that the injury was job-related.

- Paperwork or deadlines were missed.

- The injury developed over time (like repetitive stress) and is harder to prove.

- The employer argues you had a pre-existing condition.

If this happens, don’t give up. I’ll guide you through the appeals process and fight to secure the benefits you’ve earned.